summer school 2025

HeteroGENEOus agents in asset pricing

Monte Ahuja College of Business, Cleveland State University

August 04 – 07, 2025 (in-person)

1. Goals

The goals of this four-day program are twofold:

- Provide participants with a solid understanding of the current state of the literature on asset pricing models with heterogeneous agents.

- Introduce participants to state-of-the-art solution methods for general equilibrium heterogeneous-agent models in asset pricing.

The hope is to equip participants with the necessary knowledge and tools to conduct research in this area.

2. Approach

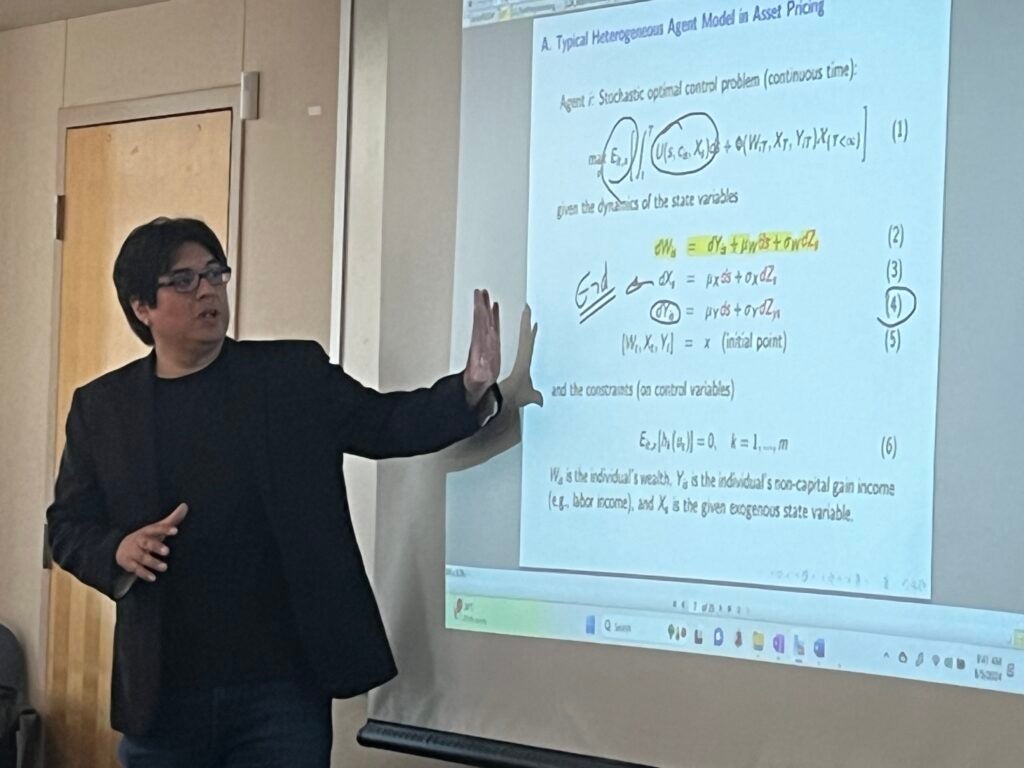

We will adopt a practical, hands-on approach, emphasizing the use of key tools. The workshop will cover topics such as dynamic programming in continuous time, asset pricing models with a single agent in continuous time, numerical methods for solving dynamic continuous-time models involving multiple agents, and a comprehensive literature review. By the end of this workshop, participants will have successfully solved a heterogeneous agent model in asset pricing and will depart with the computer code necessary for their ongoing research.

3. Target audience

Advanced Ph.D. students and Faculty in finance and related fields. All the students attending the summer school have finished the 2nd year of Ph.D. or equivalent at the beginning of the Summer School.

4. Paper Presentation

There are few slots for participants to present their papers. Papers in the early stage are welcome. This is a fantastic opportunity to get feedback and find coauthors.

5. Organizers

- Hamilton Galindo Gil, Cleveland State University.

- Tom Phelan, Federal Reserve Bank of Cleveland.

- Ji Huang, The Chinese University of Hong Kong.

6. Program

Summer School

Testimonials: Summer School 2023

The Heterogeneous Agents in Asset Pricing program was a valuable introduction to the frontier of research in this area. I was exposed to a theoretical and computational background in how to think about addressing research questions in this field. Importantly, the instructors were happy to talk through the complicated nature of these problems, and in so generating useful discussion and ideas among the cohort of students.

I have learned a lot about the new modeling techniques in the recent macro-finance research and the trends in related literature. It is also a good opportunity to make friends.

The program seamlessly integrated theory with practical coding resources, providing me with a robust understanding of heterogeneous-agent models in asset pricing. Professors Galindo and Phelan, not only experts in their field, but were exceptional communicators, breaking down complex theories into compact and engaging lectures. The friendly environment also facilitated connections with both the instructors and classmates who shared similar interests. I truly recommend this summer school for an enjoyable exploration of the frontiers in asset pricing!

This summer school helped me better understand the probability theory behind the asset pricing topics as well as untangle the programming codes in finance research. Dr. Galindo Gil and Dr. Phelan are great speakers. Their lectures are well-prepared and easy to follow. They are very happy to answer questions during the lectures and the breaks. Moreover, these two professors helped get funds to offer all participants three meals and snacks all day and free parking on campus. Participants can one hundred percent focus on learning and communicating with each other.